Fueling success through passion, know-how, and processes

Investing in high-tech can be challenging with so many projects in the market. But with ICEO's venture building model, you can trust our in-house teams of experts and proven processes that have already produced multiple profitable startups and attracted external funding. Our vision is to be the leading venture-building firm, fueling the success of innovative startups worldwide. We believe in the power of the venture building model and the potential of Web 3.0 to revolutionize the tech industry. We are excited to be at the forefront of this change and to help shape the future of technology.

Merging innovation and experience to build future-ready firms

With over 12 years of experience in building successful tech companies, we have developed a complete ecosystem of competences, relationships, and know-how. We use a proven venture-building model to create innovative startups that address real market needs and have the potential to be profitable and fully autonomous within ~18 months.

42

realised startups

$100 mln+

portfolio value

2010

on the market since

16

exits

Our expert venture building model does the work

Pragmatism

Addressing the needs

We build useful technology companies, addressing real consumer needs, based on successful business models. These have the potential to be profitable and fully autonomous within ~18 months.

- An effective venture building model based on 12+ years of experience.

- Future-ready companies in FinTech, Big Data, and Web 3.0.

Networking

Focus on relations

We base our partnership with investors on trust and transparency. We know that this is essential for building lasting relationships. We are committed to a long and mutually valuable cooperation.

- We focus on transparency and trust.

- We aim to build long-term partnerships.

Capital

Flexible approach

We follow a process with well-defined steps. We subject decisions to constant analysis of the results - if the project does not meet our expectations, we kill it and transfer resources to another idea.

- Binary decisions do not work for us.

- We remain flexible in the use of resources.

Professionalism

Continuous assessment

We are enthusiastic about what we do, but maintain a healthy level of emotional attachment to each of our ideas. If they don’t work, we pivot or kill them quickly.

- We take a rational approach and monitor the results. We are not fortune-tellers.

- We focus on minimizing risk and sustainable growth.

Passion

Hands-on engagement

As a Venture Builder, we act as founders, we are responsible for operational work and building companies ourselves, on top of acting as investors. We pick attractive businesses that we create out of passion and we want to be fully committed to.

- We aim for long-term cooperation and relations.

- We pick projects we are passionate about.

Venture building startups rock(et)

Venture building startups rock(et)

Better economics

Founder economics

We get higher equity than typical VCs due to founder economics

Less dilution

Our building processes are time and cost optimized, that reduces capital needs and dilution

Recycling investment

We reuse learnings from successes and failures („compounded learning”), as well as other assets, e.g. code and IT infrastructure

Bigger chance of success

Better pipeline

We find opportunities and build ventures, we don’t wait for quality deal flow

Shared resources

We can share talent, customers, tech, and infrastructure in our portfolio companies

Access to talent

We attract top talent that standalone ventures cannot, our portfolio companies have access to best people from the day one

Hands on approach

We are not a passive observer but we provide strong support to help our portfolio companies grow and achieve goal effectively

Brand effect

As we succeed, our brand helps in biz dev, hiring, fundrising („Sequoia effect”)

They invested in our companies

Join as an investor

Innovative companies

Take part in investment rounds of individual companies from the ICEO portfolio. Together we will discuss the financial terms and select the best solution. Partnership opportunities for business angels, seed funds, venture capital funds.

Investment partnerships

If you're interested in creating startups in our venture building model, we invite you to fill out our contact form dedicated for professional and well informed investors, including HNWIs, family offices, VC funds, funds of funds, and business angels.

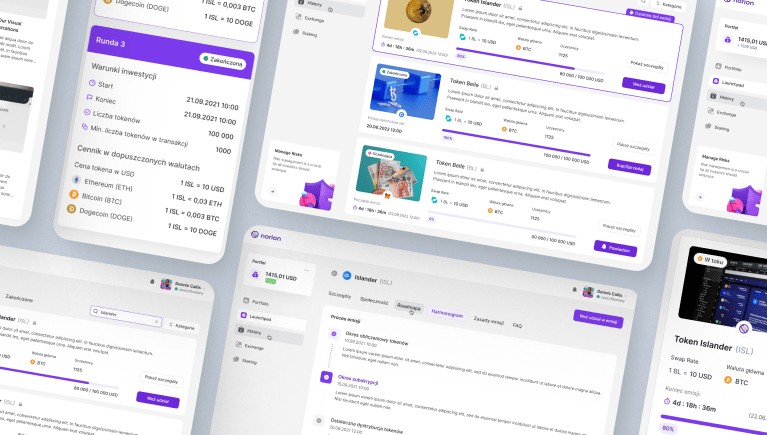

Explore our current projects

Discover our portfolio of companies based based on cutting-edge technology, and hitting real market needs.

They wrote about us